When you need money for home repairs, you have choices like home equity loans and payday loans from Eloan warehouses. Home equity loans offer more cash but take longer to approve and use your home as collateral.

Payday loans are faster, usually within a day, and can cover urgent repairs like plumbing or electrical work. Let’s look at typical repair costs to help you plan.

Key Details

- Started: May 3, 2020

- Business Type: Limited Liability Company (LLC)

- Location: 13526 W Trepania Rd, Hayward, WI 54843-2264

- Phone Number: (855) 650-6641

- Business Director: Lee Harden, Director of Compliance

Difference b/w Personal and Payday Loans

There are some difference about personal and payday loans:

Amount

Personal LoansOffer higher amounts and longer repayment periods (1-7 years) with lower interest rates.

Payday Loans Provide smaller amounts for short durations with higher interest rates.

Rates and Fees

Personal loans Generally have lower interest rates, typically ranging from 6% to 36% APR.

Payday loans May include origination fees or prepayment penalties

Loan Purpose

Personal loans Can be used for various purposes such as debt consolidation, home improvements, or major purchases.

Payday loans Borrowers have flexibility in how they use the funds.

👍Advantages of ELoan Warehouse

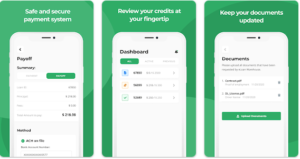

- Apply online and get funds quickly compared to traditional banks.

- Their rates are higher than banks but lower than typical payday loans.

- They help people with less-than-perfect credit scores.

👎Drawbacks of ELoan Warehouse

- Loans come with higher interest rates; understand the total cost before borrowing.

- Check if they operate in your state.

- They claim sovereign immunity, which means they can’t be sued in court.

Tips Before Choosing ELoan Warehouse

- Understand all terms and fees.

- Confirm they operate in your state.

- Look at other loan options before deciding.

Loan Terms and Conditions

Make sure you understand all the terms and conditions of an ELoan Warehouse payday loan. Take the time to get a better understanding of the total cost of borrowing, including interest rates, fees, and the repayment expectations.

ELoan The application requires proof of identity, income, and banking details, and approved funds are typically deposited directly or given in cash. Borrowers authorize automatic repayment from their bank account on the due date.

It should be noted that ELoan Warehouse belongs to the Lac Courte Oreilles Band of Lake Superior Chippewa Indians, and so they are exempt from lawsuits. Regulations and consumer protections vary from state to state, so it’s important to understand them before signing.

Creditninja Payday Loan

CreditNinja offers payday loans to help people cover urgent expenses between paychecks. These short-term loans are easy to apply for and provide quick access to cash, but they often come with high interest rates, so it’s important to borrow responsibly and understand the terms.

Borrowers should ensure they can repay the loan on time to avoid additional fees and potential debt. CreditNinja aims to provide a fast financial solution, but it’s crucial to weigh the costs and benefits before taking out a payday loan.

FAQ

What are the interest rates for payday loans?

The interest rates for payday loans can vary widely depending on the lender and your location. Typically, they are very high, often exceeding 300% APR (Annual Percentage Rate). It’s crucial to carefully review the terms and understand the total cost before taking out a payday loan.

What is Eloan Warehouse?

Eloan Warehouse is not a widely recognized term. it’s a specific service or company, it might be related to providing loans or financial services.

How do payday loans work?

Payday loans are small loans you get to cover expenses until your next paycheck. You borrow a small amount of money and pay it back, along with extra fees, when you get paid again. They’re quick to get but can be pricey because of high fees and interest rates.