Upstart Holdings ( UPST) is an exciting company in the financial technology (fintech) sector.

This company has been catching the eye of investors and market watchers. In this article, we will explore what stock Holdings does, how it has been performing, and what its future looks like.

What is Upstart Holdings?

This stock Holdings started in 2012. It helps people get loans using artificial intelligence (AI).

Unlike traditional banks that mainly look at credit scores, Upstart also considers other factors like your education, job history, and the school you went to. This method helps more people get loans and reduces risk for lenders.

What Make UPstart Different

It is different from other lenders because it uses AI to make loan decisions. This AI looks at many details about a person to decide if they should get a loan.

This way, Upstart can approve more loans with lower risk. This system is more inclusive and can help people who might not get loans from regular banks.

Performance

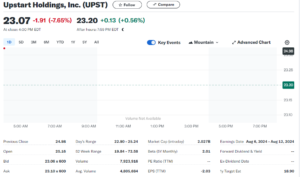

Since Upstart’s IPO in December 2020, its stock has gone through many ups and downs. Even with this volatility, It has shown strong growth, especially during the COVID-19 pandemic.

In 2021, Upstart’s revenue more than doubled in the first three quarters. Their use of AI has helped them reduce loan defaults and increase profits.

Developments

Recently, It has made some important moves:

- New Partnerships: In March 2022, It partnered with a big car loan company. This means they are now helping people get loans to buy cars. This partnership helps Upstart diversify and earn more money.

- Better Technology: It keeps improving its AI and data systems. This helps them approve loans faster and more accurately, keeping them ahead in the fintech industry.

Future Opportunities

Upstart has many chances to grow in the future:

- Online Lending Growth: As more people use online services for loans and banking, It can attract more customers with its digital platform.

- Expanding Markets: By entering new areas like car loans, It can reach more customers and increase its earnings.

Challenges

Upstart also faces some challenges:

- Competition: The fintech industry is very competitive with many companies fighting for market share. It needs to keep improving to stay ahead of its competitors.

- Regulations: There are many government rules for companies that lend money. It must follow these rules carefully to avoid problems and continue innovating.

Regulations

Regulations are important in the lending industry to protect consumers and ensure fair practices.

Upstart must navigate these rules successfully while continuing to grow and innovate. This balance is crucial for their long-term success.

Conclusion

Upstart Holdings is a unique company using AI to help people get loans easily and safely. With smart partnerships and continuous improvements in technology, It has shown strong growth and resilience.

While there are challenges from competition and regulatory requirements, It’s innovative approach and expanding market presence suggest a bright future.

Investors and market watchers will continue to keep a close eye on It as it navigates the evolving financial landscape.